Is AI Ready to Replace Humans for Consumer Insight?

Julie Thibault

Since the launch of Chat GPT just a couple of years ago, the staggeringly fast progression of Artificial Intelligence is permeating business practices in every industry and job function. From customer service to legal precedent, AI’s burgeoning use cases promise less reliance on fallible human intelligence.

When it comes to consumer insight, the thought of using AI as a substitute is very appealing. Humans are difficult to find and recruit. Humans are contradictory and unpredictable – they often say one thing but actually do another. Humans also want to be compensated for their thoughts and opinions, which gets expensive. So, when Business of Fashion recently published their “Brand Magic Index – a quantifiable and trackable metric that measures the quality of the brand-customer relationship” using “proprietary AI models that understand emotion, culture and context”, we were intrigued. LookLook is in the business of consumer-driven insights with a strong focus on luxury sectors; the most difficult when it comes to finding qualified participants. Definitionally, there aren’t many luxury buyers (think 1%) and typical study incentives are not that motivating to this demographic. We wanted to know, is AI ready to make a meaningful contribution to consumer insights?

The Brand Magic Index Output

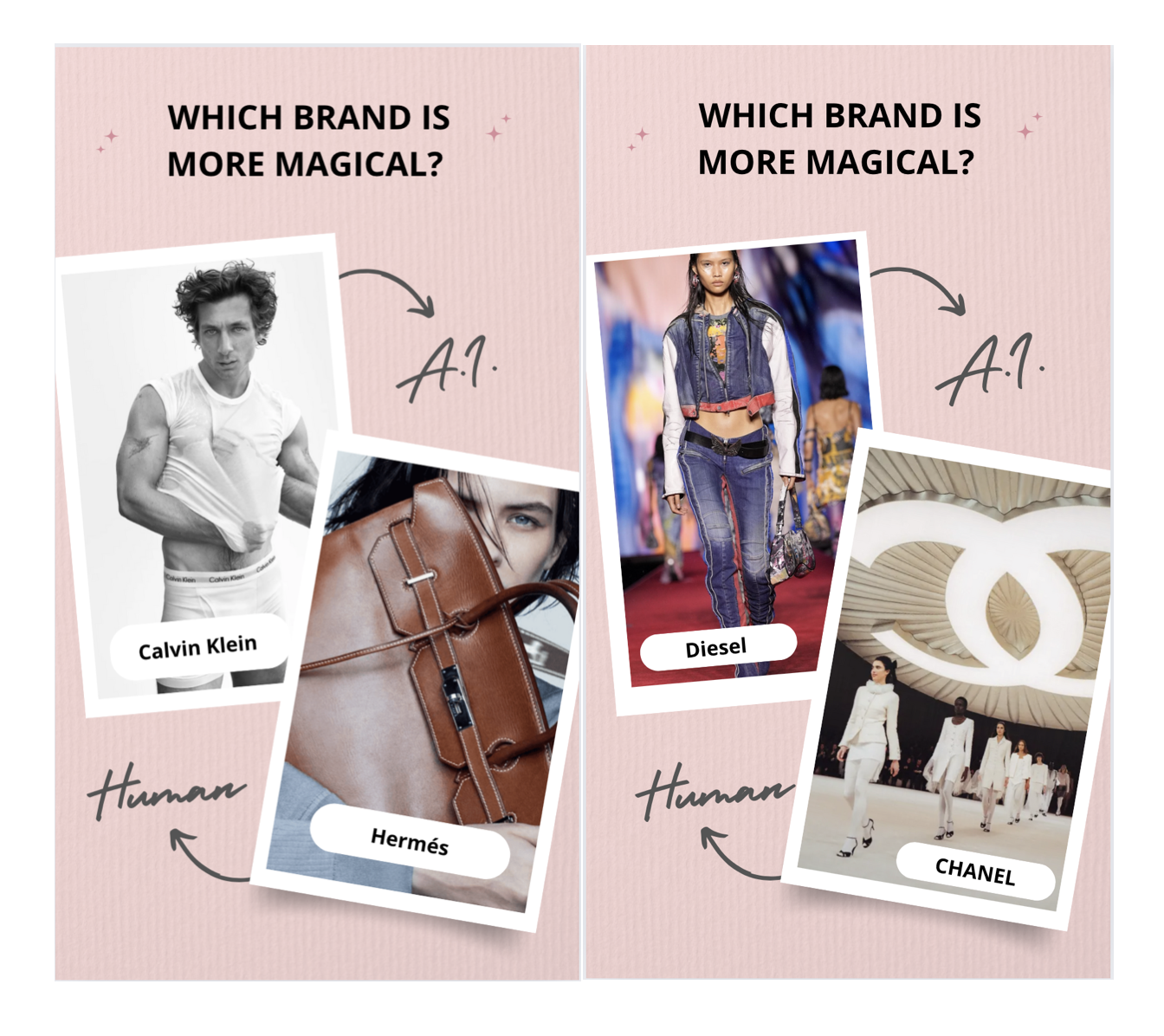

Business of Fashion Insights and Quilt. AI’s Index ranks 50 luxury brands based on the quality of the brand-customer relationship. It is meant to be a tool to help brand managers measure the impact of their marketing spend by analyzing publicly available social media posts as well as search data. Below is the Index’s top 20 “Most Magical Brands”

| Rank | Brand | Rank | Brand |

| 1 | Dior | 11 | Loewe |

| 2 | Louis Vuitton | 12 | Gucci |

| 3 | Versace | 13 | Jacquemus |

| 4 | Calvin Klein | 13 | Maison Margiela |

| 4 | Hermès | 15 | Prada |

| 6 | Valentino | 16 | Chanel |

| 7 | Balenciaga | 17 | Ralph Lauren |

| 8 | Diesel | 18 | Alexander McQueen |

| 9 | Loro Piana | 18 | Miu Miu |

| 10 | Armani | 20 | Celine |

Source: Business of Fashion and Quilt.AI

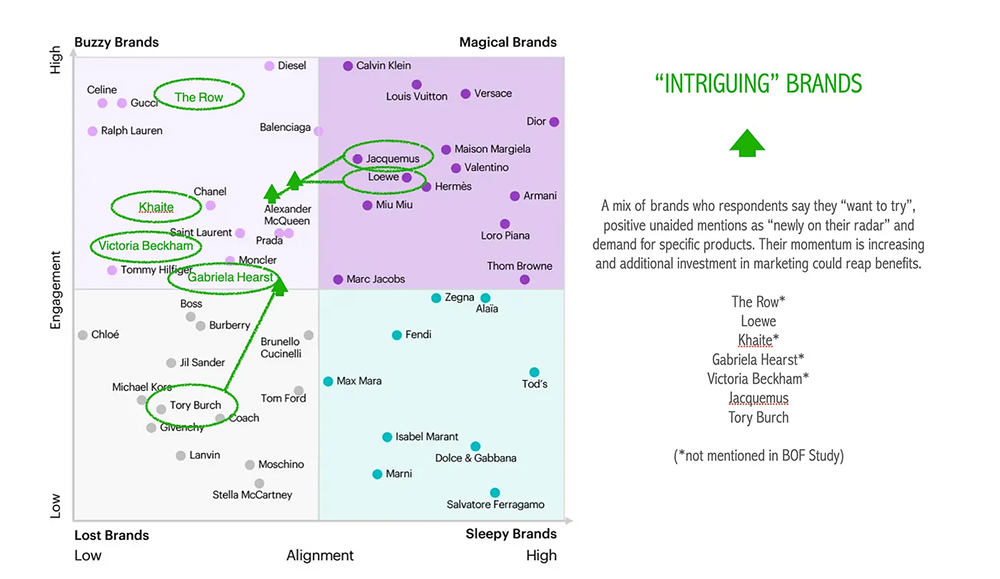

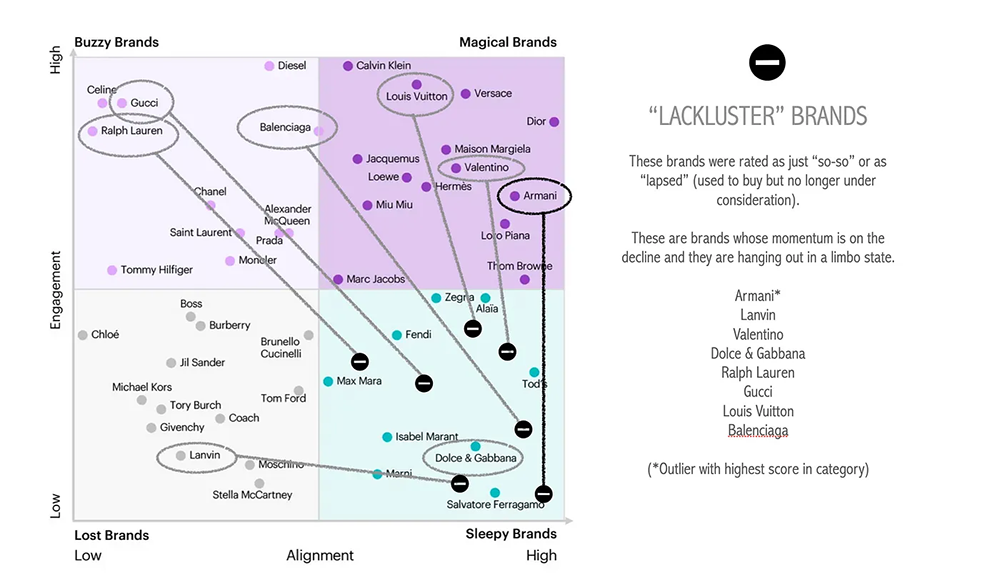

Fifty brands were plotted on a quadrant that visually showed the output based on the “timelessness of their identity with the timelessness of the culture”. Brands in the top right quadrant are seen as having consistent brand identity while also being relevant to current zeitgeist. The bottom left quadrant do not maintain consistent brand identities and are not currently a topic of conversation on social media.

Some Things Seemed Off

The team at LookLook spends a lot of time with luxury consumers gleaning insights on behalf of the world’s top luxury brands but also with our own cultivated communities of luxury buyers in the US and China (LuxuryVerse). Based on our own proprietary data a number of findings from the Brand Magic Index seemed off to us. For example:

- Chanel is not seen as having a consistent brand identity

- Calvin Klein and Diesel ranked higher in terms of “buzz” than brands like Loewe, Hermès, Chanel and Prada

- Alaïa is a “sleepy brand” with good brand alignment but less “buzz” than Armani

These were just a few insights from this study that made us wonder, was using AI to predict the desirability of a brand a flawed methodology? Luckily, we had some of our own data to analyze to compare to BoF’s Magic Index.

Comparing Human Insights to AI

LookLook’s business model is centered around our network of high-net-worth, highly engaged luxury buyers. Over a decade of qualitative work for luxury brands has led to these connections. Last year we cultivated a small cohort of these buyers in the US and China called the LuxuryVerse. At the end of the year we conducted a US study to measure their feelings towards luxury brands. We layered this data with qualitative feedback from both the members of the LuxuryVerse and fashion sourcers.

Our methodology is VERY different from that of BoF and Quant.AI, making direct comparisons difficult. Also, we are looking at US consumers only, while social content could come from anywhere. We caveat this by saying the differences are directional in nature and meant to generate discussion around the quality of insights gleaned from AI and public data vs individually recruited humans.

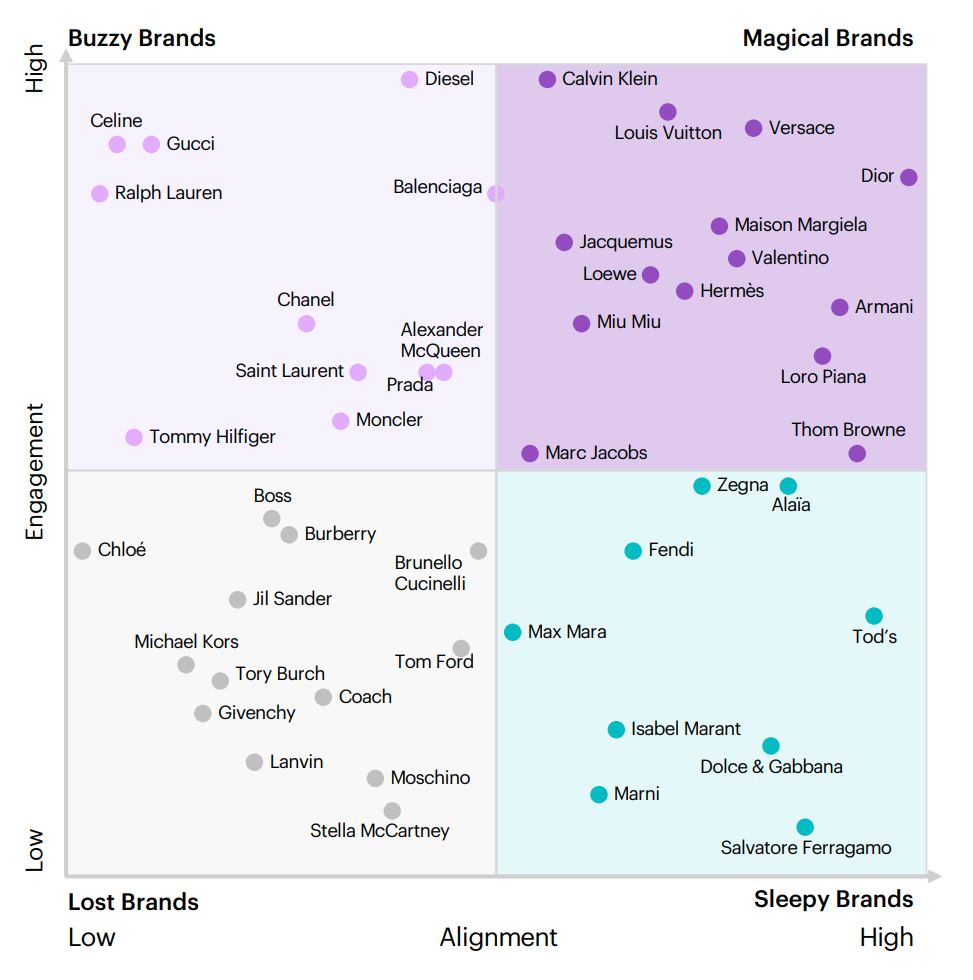

LOVE Brands vs. Magical Brands

We call the most valuable brands, according to our LuxuryVerse US members, “LOVE” brands. In our work, there were only 4 brands that qualified based on a quantitative “net love score” that is simply the difference between brand devotees who say they “love” the brand with brand detractors who would in “no way” consider it. Brands with a score of 65 or higher made the cut. There was one clear outlier in this category, Chanel, and we were surprised to see it outside the “magical” quadrant (along with 2 other of our LOVE brands). Our members view Chanel as highly desirable, in multiple categories from RTW to accessories, but also as a great investment that holds its value.

Why it matters: For luxury buyers looking for long-term investment in classic pieces that will hold their value, LOVE brands are the gold standard. They are open to buying in multiple categories from RTW to handbags and they are willing to tolerate higher price points if resale demand is robust.

Fact Check on LOVE brands – Q1 results

There is a reason that reaching LOVE status is both hard and desirable. These brands have a resilience that allows them to weather tougher economic times. Here is Q1 2024 revenue growth for 3 of the brands our members LOVED*:

- Hermès +17%

- Chanel +16%

- Prada Group +11%

*Celine is part of LVMH and financial data for this brand is not publicly available

In comparison, the brands that were rated as more “magical” or “buzzy” in the BoF Brand Index did not fare as well:

- LVMH’s Fashion and Leather goods + 2%

- Gucci Group -18%

- Calvin Klein International 0%

Intriguing Brands vs. “Buzzy” Brands

We are constantly curious about brands that are gaining momentum when it comes to entering the consideration set of the luxury buyers. We also believe that qualitative insight is key when it comes to measuring upward momentum. (Without the “why” explaining attitudes and behavior, the data is somewhat flat.) We look at unaided mentions of the brand or key products (both from LuxuryVerse members and fashion sourcers) as well as aided responses to “I want to try”.

These are a mix of newer brands with lower awareness or more established brands that are suddenly interesting again. Their design and positioning resonate and they feel relevant and “of the moment”. In this category, we saw a lot of female designers like The Row, Khaite and Victoria Beckham who weren’t included in the Brand Magic Index. Tory Burch was also having a moment, particularly based on requests from Fashion Sourcers.

Why this matters: When looking for alternatives to high priced, hard-to-source items from LOVE brands, they find substitutes here. Also, these brands are an antidote to the ubiquity of many of the bigger fashion houses. At more accessible price points they are poised to take “share of closet” and many are already dominant in specific categories that are seen as wardrobe staples like Khaite with denim/knits, Victoria Beckham with makeup and Loewe and the Row in handbags.

Lackluster Brands vs. “Sleepy” Brands

Lackluster brands were those that scored the highest on the “meh” or “lapsed” metrics. There is high awareness but middling desirability. Many members used to be clients of the brand but have lost touch with it recently. There was one key outlier here with the fewest brand devotees and low momentum in terms of intrigue, hence giving it the highest “lackluster” score – Armani.

Why this matters: While there might still be trust in brand quality, desirability has waned. Beloved pieces are still held in the closet but the brand is no longer top-of-mind when considering new items.

Garbage In, Garbage Out

Artificial Intelligence is likely not the key driver of the discrepancies between the LuxuryVerse brand perceptions and the Brand Magic Index. We believe it lies in the data that AI is analyzing. Let’s start with social buzz. There is no way to qualify a social post on a brand – Is it done by someone who is actually a luxury consumer? Or just someone with an opinion? In addition, only public accounts are available for analysis. If the Internet Participation 90-9-1 Rule, (90% of people online are “lurkers” and only consume content, 9% may edit content or comment and 1% actually create content) holds true, then social content only reflects the 1% of people who are willing to publicly voice an opinion. While this principle is a rule of thumb, we know that a majority of our LuxuryVerse participants do not have public social accounts because they value privacy and discretion. Therefore, the basis of any social buzz analysis must acknowledge that the opinions they are analyzing are not necessarily from the actual addressable luxury market.

The counterargument is that content creators wield outsize influence on the luxury buyer. We don’t dispute this, but we believe that that influence will be accounted for in the perception of the brand by the end customer. Meaning, if the UGC or brand content was impactful, luxury consumer responses will reflect it.

The same argument holds for brand consistency. A subjective lens of how consistent brand messaging is with brand image is useful when it comes to brand management. That said, if a brand deviates from its typical standards it doesn’t always mean it is negative. Again, if it is impactful, luxury consumers will respond accordingly.

The Limitations of AI When It Comes to Consumer Insights

Humans are unpredictable and challenging to analyze. If you find the right humans (a big if), analyzing their responses is an art form. There are inherent contradictions. We are excited about the application of AI and other data analytics as an input to validate or dispute human responses. For example, we like action-based data like search and resale value that are great sanity checks for opinion-based response data. Search and sales data is anonymized and, therefore, we see it as a more holistic data point than social buzz because it isn’t just the people that have public accounts.

That said, the most important factor in consumer insights is human – the humans that will ultimately be the ones consuming your goods and services. When AI starts buying its own handbags, we will be happy to add it to our cultivated communities (just kidding, we might “hire” it as an analyst, though).

**To field your own brand equity study or for inquiries regarding the 2024 luxury brand study (fielding in September) please email us at info@looklook.app